Turn Old Policies into New Opportunities: A Real-World Review Guide for Insurance Agents

Let’s be honest—life insurance policies are often “set it and forget it” for clients. But as agents, we know better. Life changes, interest rates shift, and what made sense five or ten years ago might not be working today.

If your client’s policy hasn’t been reviewed in a while—or they’ve had a major life event—it’s time to take a second look. Not just for compliance, but to create value, build trust, and potentially open the door to new business.

At EMG, we make the review process simple. Here’s a proven, step-by-step system you can follow with any client, starting today.

6 Easy Steps to a Smart Policy Review

- Grab the Latest Statement

Start by asking the client for a copy of their most recent life insurance statement. No need for the full policy—we’re just looking for the current numbers: cash value, premium, projections, etc. That gives us the real-time status of how the policy is performing.

- Get Authorization

Have your client sign EMG’s Release of Information form. This lets us go straight to the carrier and request the detailed in-force illustration and policy data you’ll need for the review.

- Team Up with an Expert

Once we have the policy details, one of EMG’s insurance specialists will work alongside you to analyze the numbers and check for any red flags. We’ll help you figure out whether the policy still fits your client’s goals—or if there’s a smarter alternative.

- Meet with the Client

This is where you shine. Walk your client through the findings. You’ll show them what’s working, what’s not, and what their options are. It’s your chance to add real value by translating policy jargon into plain-English advice.

- Take Action

If the review uncovers any issues, such as a policy projected to lapse early or no longer aligning with your client’s goals, you will have a clear plan of action. We can assist with updated illustrations, explore replacement options, or guide you through a 1035 exchange.

- Follow Up

Make sure all paperwork is submitted and nothing falls through the cracks. A quick follow-up keeps everything moving and shows your client you’ve got their back.

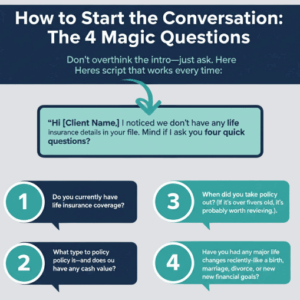

How to Start the Conversation: The 4 Magic Questions

Here’s a script that works every time:

“Hi [Client Name], I noticed we don’t have any life insurance details in your file. Mind if I ask you four quick questions?”

- Do you currently have life insurance coverage?

- What type of policy is it—and does it have any cash value?

- When did you take the policy out? (If it’s over five years old, it’s probably worth reviewing.)

- Have you had any major life changes recently—like a birth, marriage, divorce, or new financial goals?

If they answer “yes” to any of the above—it’s time to book a review.

Why Policy Reviews Matter More Than Ever in 2025

Interest rates are finally climbing again—but most older policies were built in a low-rate world. That means:

- Premiums might be increasing

- Coverage might not last as long as expected

- Cash value may be underperforming

Even solid policies can go sideways over time. A review now could prevent big headaches later—and potentially create new opportunities for you as the advisor.

Next Step: Make It Easy

Once they’re on board, keep the momentum going:

“Would you be able to email me a copy of your most recent annual policy statement—or would it be easier to drop it in the mail? My assistant will follow up once we have it. Thanks so much!”

Simple. Direct. Professional.

Bonus: Appointment Confirmation Script

Need a reminder message that doesn’t feel pushy? Try this:

“Hi [Client Name], just confirming our appointment for [Day] at [Time]. Also, we’re updating your client file and noticed we don’t have any info on your current life insurance. If you could bring the latest policy statement with you, that’d be perfect. No need for the full policy—just the most recent summary is all we need.”

Bottom Line

Policy reviews aren’t just about fixing problems—they’re a great way to reconnect with clients, uncover hidden opportunities, and show your value as a trusted advisor.

Need help reviewing a case? EMG is here to back you up—from paperwork to policy analysis to next steps. Let’s turn those old policies into new wins.

Reach out to your EMG Sales Advisor today to get started.